The Indian Investment Landscape

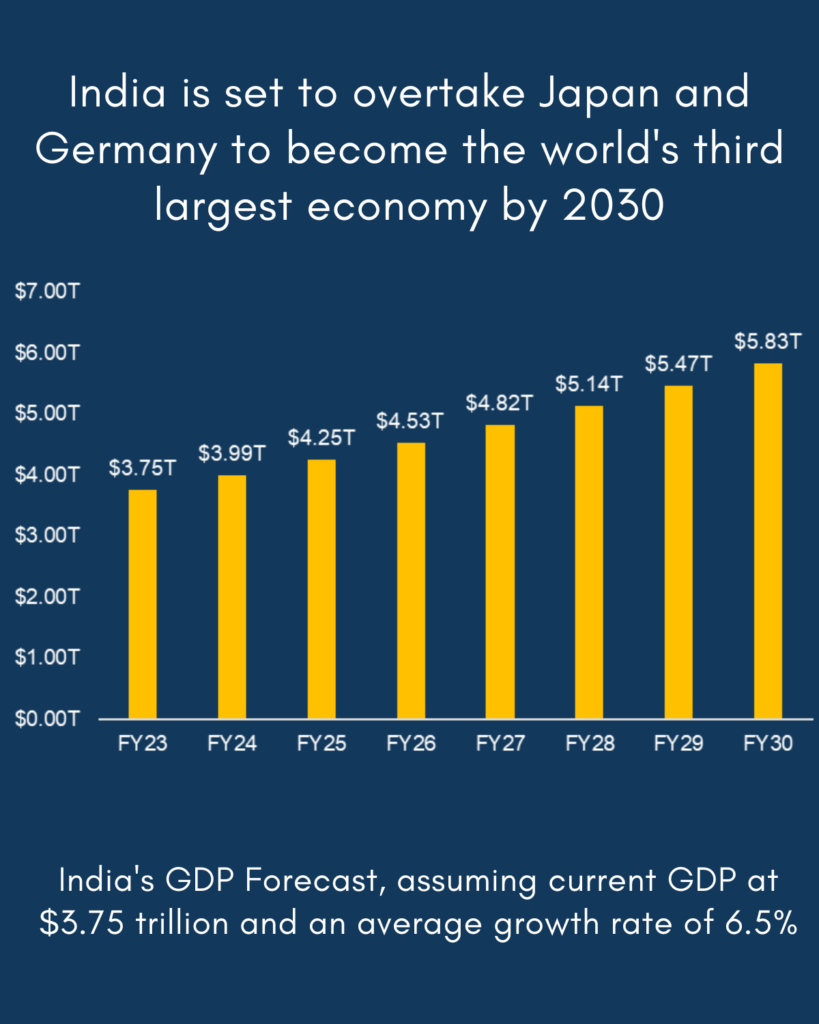

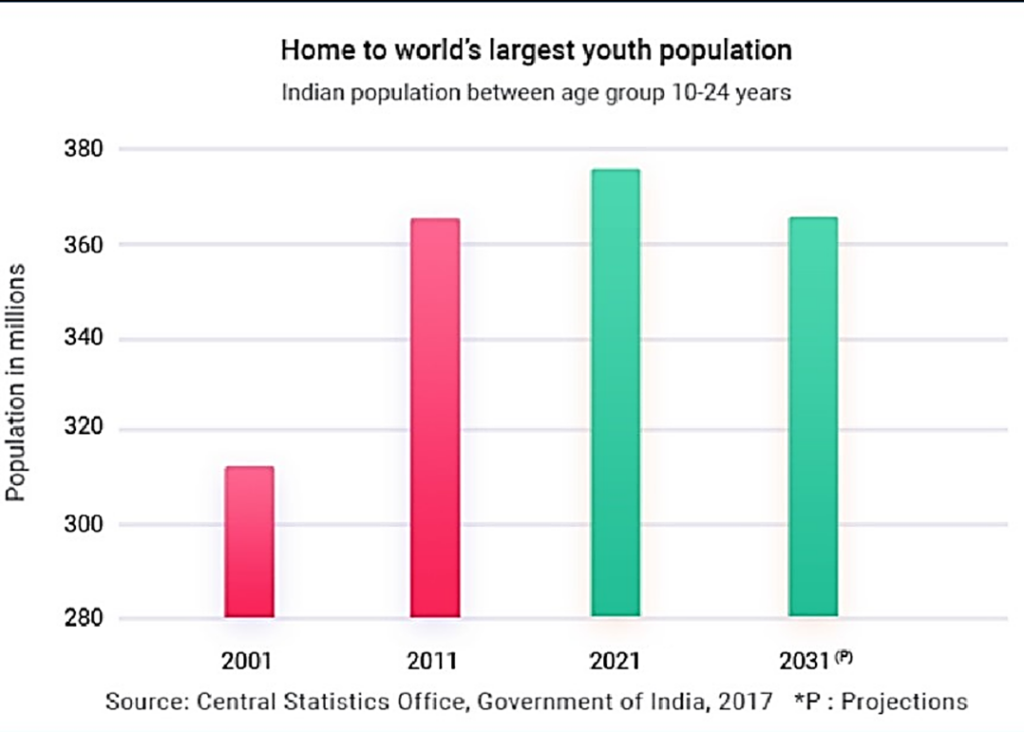

Have you thought about investing in India? It’s not just a land of rich culture and history. In fact, India offers a booming market and a young, vibrant population of 1.3 billion. Plus, it’s strategically located between the Middle East and Southeast Asia. The economy is growing fast. Also, there’s a highly skilled workforce, especially in IT and engineering. So, it’s easy to see why India is quickly becoming a top pick for global investors.

Why Invest in India now?

- India is a bright spot for investment. Firstly, the tech industry is set to grow big.

- Additionally, strong government support is fueling a startup wave. As a result, new companies are sprouting up all over. For instance, Bangalore is becoming India’s Silicon Valley, attracting tech talent worldwide.

- Moreover, the government has plans to expand fast internet to rural areas. Consequently, this move is opening new doors for digital investments.

- Meanwhile, the healthcare market is rapidly growing, driven by a health-conscious public.

- Lastly, major projects, like the ‘Smart Cities Mission,’ stand ready for investors, and these efforts are actively shaping India’s cities for the future.

Feeder funds vs Direct funds

Feeder Funds offer a convenient way to invest in a larger ‘master’ fund based in India, providing a simplified entry point into Indian assets.

Direct Funds, denominated in USD(NAV), allow direct investment in a variety of assets like equities, bonds, and alternatives such as real estate. These funds offer more control and choice for investors as they are mostly open ended funds with a choice to buy and exit at NAV.

For both Non-Resident Indians (NRIs) and foreign investors, these options offer unique avenues for diversification allowing them to invest in one of the world’s fastest-growing economies

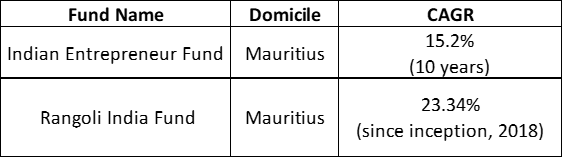

The following is a list of India-focused USD funds, but it is not an exhaustive list. There are many other funds available, and investors should do their own research before investing.

These funds generally follow a monthly subscription model and the units can be redeemed at market price.

Taxation

Taxation Policy for Foreign Investors in India

Foreign investors in India generally face taxes only in their home country, thanks to India’s Double Taxation Avoidance Agreements (DTAAs) with over 90 countries.

UAE Nationals and Their Unique Tax Benefits

For our friends in the UAE, the deal is even sweeter. A special treaty allows profits earned in India to flow back to the UAE tax-free. It’s a win-win!

Understanding the Double Taxation Avoidance Agreement (DTAA)

DTAAs are investor friendly, preventing double taxation and ensuring favorable tax rates on income earned in India.

Conclusion: Are You Ready to Invest in India?

India stands as a beacon of opportunity, with a market that is both welcoming and teeming with potential. From its rich, diverse culture to its array of investment prospects, this nation is more than ready for investors looking to make a significant impact. For those eager to embark on this promising journey, expert guidance is readily available.

To know more about Investing in India, reach out to us below