JTL is an integrated manufacturer and supplier of steel tubes, pipes and allied products in India. The company has a network of more than 800+ Distributors and Retailers and 1000+ SKUs. The company manufactures and supplies various steel products, such as ERW pipes, galvanized pipes, and solar structures. These products are used in different sectors, such as water transportation, agriculture, infrastructure, solar power, heavy vehicles, energy & engineering, and more. The stock has provided returns exceeding 10 times over the past 3 years. Now, let us assess whether the stock will continue to deliver favorable returns in the future.

Key Clients:

Tata Power | IGL |

Avaada | Ashok Leyland |

Har Ghar Jal | Essar |

Siemens | Elecon |

Mahanagar Gas | Suzlon |

HPCL | Thyssenkrupp |

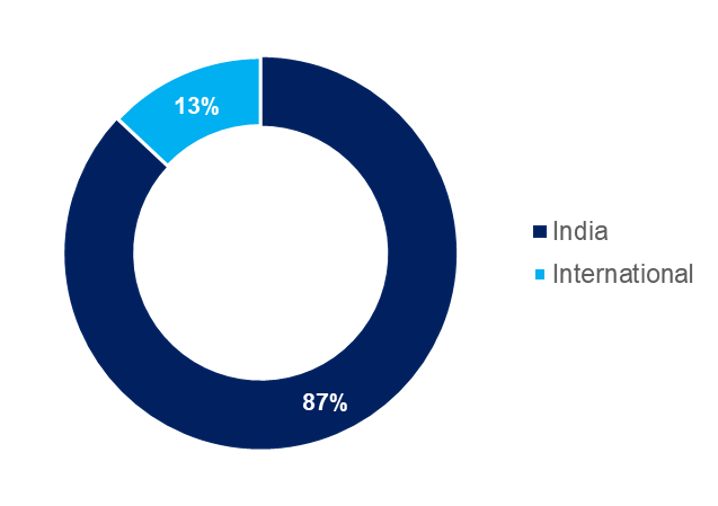

Revenue breakup: (Geography)

The company’s products are supplied to over 20 countries with various clients in the UK, Netherlands, Belgium, Ethiopia, and Australia.

JTL Industries Growth Drivers:

1. Capacity Expansion Initiatives:

Currently operating at full capacity, JTL Industries plans to expand its total installed capacity from 5.86 lakh tons to 10 lakh tons by F25, and further to 20 lakh tons by F27, enabling it to meet growing demand and capture market opportunities effectively.

2. Expansion of Value-Added Products:

Over the next two years, JTL aims to increase the proportion of value-added products to over 50%. This strategic initiative is designed to enrich the company’s product portfolio and boost margins derived from its offerings.

2. DFT Deployment:

JTL is planning to deploy DFT in its plants which will facilitate it to produce various sizes of hollow section without roll change, increasing efficiency and capacity utilization and also add additional SKUs.

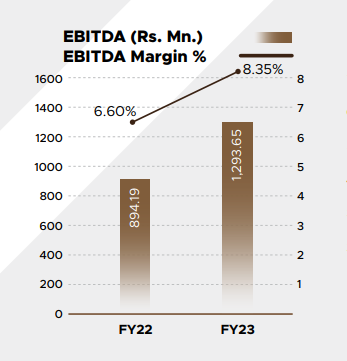

3. Margin Expansion Strategy:

With a goal to double its margin by 2027-2028, the company is focused on enhancing profitability and operational efficiency.

4. Experienced Leadership Team:

Backed by a leadership team with over 35 years of collective experience, JTL Industries boasts a blend of seasoned professionals and dynamic young talents, ensuring a strategic vision and effective execution of growth plans.

5. Strong Volume and Revenue Growth Guidance:

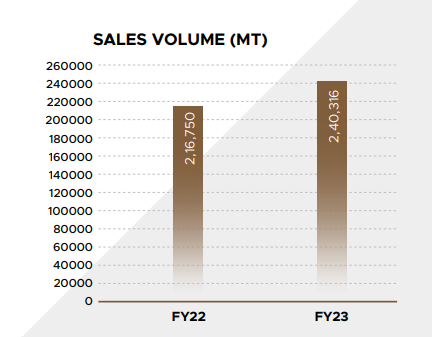

- The company has set aggressive volume growth targets. It aiming for 35%-40% growth in FY25 and FY26, and further accelerating to 40%-45% by FY28. This indicates a robust trajectory for expansion and market penetration.

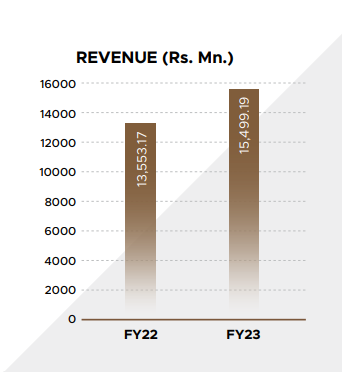

- JTL targets a revenue of 10,000 crores by the end of F27. This a six-fold increase over the next four years.

6. India’s Infrastructure Boom:

JTL stands to benefit from India’s ongoing infrastructure development, including projects in roads, airports, railways, real estate, water sanitation, affordable housing, and logistics.

- The government plans to expand its total metro network to 2,660 km from present 690km by expanding the network in exiting cities and introducing the metro in new cities. This will create a lucrative opportunity for ERW pipes, as metro networks have a high density of stations where these pipes can be used.

- Government of India plans to build over 70-80 airports by 2025 under its Udaan Scheme. For this AAI and the private sector will invest Rs 1 trillion in the next 2-3 years for this expansion.

- Government allotted Rs. 70,000 crores towards Jal Jeevan Mission which aims to provide clean drinking water to over 180 million rural households by 2024.

- Under PMAY, Government has a task of completing 4.5 million households, which will continue to drive demand for the next 3-4

- Government plans to modernize & upgrade as many as 1,275 railway stations under ‘Amrit Bharat Station’ Scheme. To support this, In its last budget, the Indian Railways increased its total capex for upgradation by 240% yoy to Rs 130 billion.

Potential Risks

- Approximately 90% of the company’s costs are attributed to HR coils, indicating a significant dependency on this raw material.

- The structural steel tube sector is characterized by intense competition, with approximately 55% of the market being unorganized.

Financials:

| Compounded Sales CAGR | Compounded Profit CAGR | |

| 10 Years: | 33% | 65% |

| 5 Years: | 56% | 62% |

| 3 Years: | 89% | 108% |

5 year view:

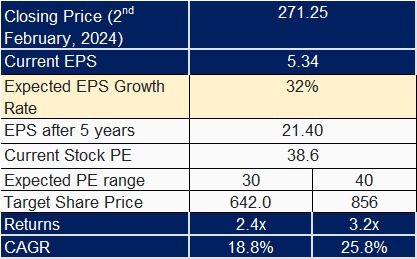

For JTL industries, we expect a 32% CAGR growth in EPS in the next 5 years.

Key reasons include expansion initiatives, the expansion of value-added products, and higher targets for sales and margin growth.

India’s infrastructure boom will also aid in the steady growth of the company.

We estimate the stock to grow by at least 2.4 times or grow by a CAGR of at least 18.8% in the next 5 years.

Disclaimer: This research is for informational purposes only and does not constitute investment advice. Please do your own due diligence and consult your financial advisor before making any investments.

You can invest in Stocks through Zerodha.

To open an account with Zerodha, please provide the information HERE.